Social Security benefits are an important source of retirement income for millions of Americans. However, many people may not know the various strategies they can use to maximize their benefits. From understanding your full retirement age to considering spousal benefits and delaying your benefits, several ways exist to increase your monthly benefit amount. This article will explore tips on maximizing your Social Security benefits and ensuring you receive the highest possible amount.

The Importance Of Social Security Benefits

Social Security benefits have become essential to the American social welfare system, providing financial assistance to millions of retired, disabled, and widowed individuals throughout the country. This program has been instrumental in reducing poverty rates among the elderly and has provided a sense of security for many who would otherwise struggle to make ends meet. Social Security benefits are important for those currently receiving them and serve as a vital investment in our future.

As the baby boomer generation continues to retire, the need for these benefits will only increase, making it even more critical to maintain and improve upon this valuable resource. Ultimately, social security benefits safeguard against a future of economic instability, providing individuals with the means to maintain their well-being and financial independence well into their golden years.

How To Maximize Your Social Security Benefits

It’s no secret that Social Security benefits are an invaluable resource for retirees, yet many overlook strategies that could increase their monthly benefit amount. Understanding and employing these strategies can lead to greater financial security in retirement. Here are some tips for maximizing your Social Security benefits:

Understand Your Full Retirement Age

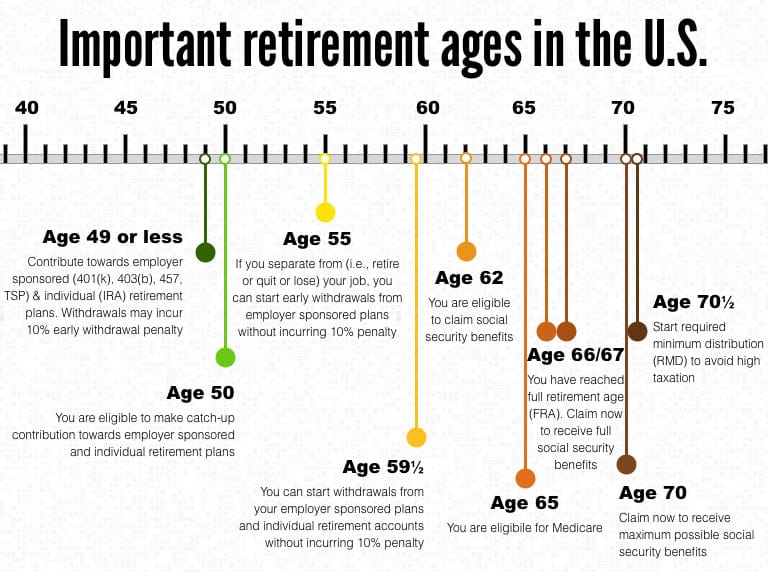

One of the key factors in maximizing your Social Security benefits is understanding your full retirement age (FRA). Your FRA is determined by your birth year and can range from 66 to 67. While you can start taking benefits as early as 62, doing so will permanently reduce your monthly benefit amount; if you wait until after your FRA to take benefits, your monthly benefit will increase.

Knowing your FRA is important to make informed decisions about when to start taking Social Security benefits. By waiting until your FRA or beyond, you could potentially receive a larger monthly benefit for the rest of your life.

Consider Your Spousal Benefits

Did you know you could be eligible for spousal benefits based on your spouse’s or ex-spouse’s work record? This means you could receive up to 50% of your full retirement benefit, which could be significant if your spouse has a higher earnings history than you do.

However, you must be 62, and your spouse must have already started receiving benefits. It’s important to consider spousal benefits when deciding when to start taking Social Security benefits. Doing so can maximize your benefits and ensure you receive the best possible outcome for your retirement.

Maximize Your Earnings History

When maximizing your Social Security benefits, your earnings history is critical. Your benefits are based on the 35 highest-earning years of your career. However, if you have not worked for 35 years, this can significantly lower your benefits. So, what can you do about it? Finding ways to increase your income or work longer is the key to maximizing your earnings history.

Take the time to evaluate your financial situation and see where you can improve. Remember, every extra penny you earn can add up to a more comfortable retirement. So, invest in your future by maximizing your earnings today.

Consider Delaying Your Benefits

As you approach retirement, it’s essential to consider how to maximize your Social Security benefits. One effective strategy is delaying your benefits until after your Full Retirement Age (FRA). By doing so, you can permanently increase your monthly benefit amount up to age 70. The percentage increase yearly is significant, translating into a relatively higher payout over your entire lifetime.

While waiting may seem challenging, it can be an insightful financial move that ensures you receive the most benefits to support your retirement lifestyle. By thinking strategically about Social Security benefits, you can secure a more comfortable retirement for yourself.

Get Advice From A Financial Planner

As retirement approaches, it’s crucial to consider ways to maximize your Social Security benefits. Consulting a financial planner can prove to be an invaluable resource in this regard. Delving into your earnings history can help you identify opportunities to enhance your benefits.

With help from a qualified financial planner, you can make informed decisions about your Social Security benefits and achieve your retirement goals. Additionally, a financial planner can guide spousal benefits and how they impact your retirement income. Moreover, they can assist with planning for taxes and other expenses that may arise in retirement.

Be Aware Of Taxes

When maximizing your Social Security benefits, being aware of taxes is crucial. Many people are surprised to learn that their benefits can be taxed depending on their income level. This means that if you’re not prepared, you could face unexpected retirement expenses.

By understanding how Social Security benefits are taxed, you can plan and make sure you’re not caught off guard. This knowledge is especially important if you’re relying on Social Security as a major source of income in retirement. So take the time to educate yourself about taxes and Social Security, and make the most of your benefits.

Keep Your Personal Information Up To Date

When maximizing your Social Security benefits, keeping your personal information up to date cannot be emphasized enough. Your work history and earnings are critical in determining the number of benefits you’ll receive.

Any errors or inaccuracies in your Social Security statement could lead to reduced benefits, so it’s important to review your statement regularly and report any mistakes to the appropriate authorities. By ensuring that your personal information is accurate and up to date, you can rest assured that you’ll receive the full benefits you deserve.

Maximize Your Social Security Benefits With These Tips!

In conclusion, Social Security benefits are an important source of retirement income, and it’s crucial to understand the various strategies that can be used to maximize your benefits. From understanding your full retirement age to considering spousal benefits and delaying your benefits, several ways exist to increase your monthly benefit amount. Seeking advice from a financial planner can also help you make informed decisions about your retirement income. By keeping your personal information current and being aware of taxes, you can ensure you receive the correct amount of Social Security benefits. Following these tips can maximize your Social Security benefits and enjoy a more secure retirement.